AboutThe smart Trick of Can You Trade In A Financed Car? - Mercedes-benz Of ... That Nobody is Talki

So study as high as possible, including the make, design, condition it remains in, repair services its had, equity you owe, and so on. Be prepared to discuss your current car loan and also the balance owing. If you have adverse equity on your payment, you'll be anticipated to pay more with a greater rate of interest.

This is conveniently one of the most important piece of the puzzle. Guarantee you understand what you're committing to before consenting to the trade-in. There's no injury in asking if you can take the agreement home to read over completely information. If a dealer vocally makes you an offer, always ask for it in creating.

Look into the rest of our blog site for more handy posts covering a wide range of subjects. Use Birchwood Credit score Solutions automobile finance calculator to exercise what you may have the ability to invest in a new car, vehicle or SUV, and look for a pre-approved auto loan online. Free Buyers' Guide Download our New to Canada Guide.

The Buzz on How To Trade In A Car With Negative Equity: Your Options

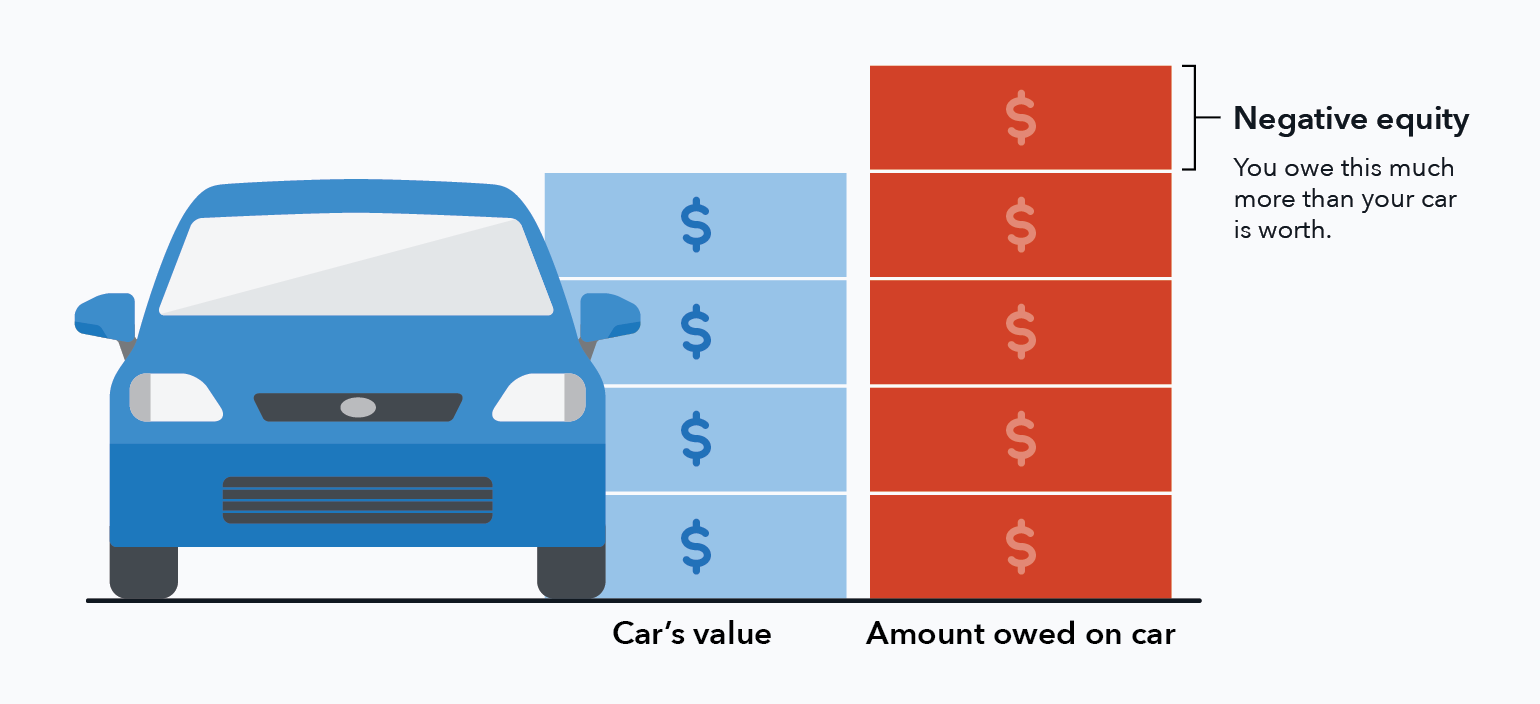

Can you trade in a funded auto? While the basic response is yes, the procedure can be a little bit foreign to Marrero chauffeurs. There are a couple of terms to remember if you intend to go regarding trading in a financed vehicle. One of one of the most vital things to keep in mind is that you have to repay the remaining equilibrium of your existing vehicle loan; trading in a funded auto does not eliminate your car debt.

If you have your eye on among our interesting brand-new versions, utilizing our trade-in value device is an excellent way to see if you can come out in advance while trading in a funded car. If you intend to trade in a funded automobile for a lease, we use competitive lease rates on tons of versions.

Visit us at Ray Brandt Chrysler Dodge Jeep Ram for every one of your automotive demands! Much More From Ray Brandt Chrysler Dodge Jeep Ram The 2021 Jeep Wrangler is far from burning out when it involves the color choice readily available. With the new Wrangler, you can discover the best combination to make certain you attract attention.

Learn How Financing A Car Works - Bank Of America Things To Know Before You Get This

Check out listed below to see just how trading in a funded cars and truck jobs: Find out the remaining equilibrium on your existing car lending. This will be listed on your month-to-month declaration or you can contact your lending institution. Make use of the Value Your Profession device on our website or a service like Kelley Blue Schedule to best car insurance companies discover an estimate on the value of your present car.

The final value will be identified by the car dealership when you bring your car in for evaluation. If the staying quantity of your car loan is much less than the trade-in deal from the dealership you can utilize the cash leftover to purchase a brand-new vehicle from the dealer. As an example, if you still owe $5,000 on your vehicle and also the supplier uses you $7,000, the rest of your funding can be repaid and also you'll have $2,000 to add towards your next auto.

Here are a couple of beginning factors. HOW DOES TRADING IN A FINANCED AUTOMOBILE FUNCTION? There are a pair of scenarios you need to think about when deciding to sell your funded cars and truck. For starters, the car lending on your auto is not forgiven. It will certainly still require to be paid off.

3 Simple Techniques For How Does Trading In A Car Work? - U.s. News & World Report

CANISTER A FINANCED AUTO BE TRADED FOR A RENTED Cars And Truck? While this isn't always the finest choice, it's worth thinking about trading your financed auto for a rented vehicle if you're in a bottom-side-up auto finance and you require something a lot more cost effective. The equilibrium of your funded car will certainly be figured into your lease offer.

PROFESSION YOUR FUNDED AUTO AT CADILLAC OF TURNERSVILLE Whatever your reason, Cadillac Of Turnersville is satisfied to assist you sell your financed car. Our money facility will aid locate the very best offer for you. Obtain a running start in your home by completing our trade-in type to value your present ride, and also don't fail to remember to make an application for funding.

https://www.youtube.com/embed/GpDzedSec7I

Exactly how Does Trading In a Financed Cars And Truck Job? In many cases, if the amount continuing to be on your financing is much less than the value of the lorry, you will certainly be able to settle the equilibrium with what the supplier pays for your trade-in. State you still owe $7,000, and the trade-in value of the vehicle is $8,000; in this example, you might settle the funding and apply the staying $1,000 to your new vehicle acquisition.